In 2022, a member of our Crew wanted to buy a music festival ticket.

Splurging for a full six-day price didn’t seem like a viable option. And as they were preparing to abandon the website, a new feature popped—pay in up to 7 months in equal installments.

Game-changer! Payments split. Music festival, here we come!

That’s usually how anyone’s first encounter with the BNPL looks. An industry that saw a wild rise in the past years—now followed by a slowdown—and mixed forecasts.

And you’re now probably wondering how BNPL—a seemingly positive feature to add to your payment process—is faring in the new economy, and will trend in the future.

So we decided to take a look.

💳🤔 How does BNPL work?

Buy now, pay later lets you get stuff now and pay for it later in installments, like breaking a big payment into smaller ones.

BNPL companies make money by charging fees to the merchants for processing transactions and sometimes by charging late fees or interest to customers who don’t pay on time.

This business model allows them to offer flexible payment options to customers while still generating revenue—and make big purchases more convenient

🖱️📈 Clicking on each individual chart will take you to its interactive looker studio board.

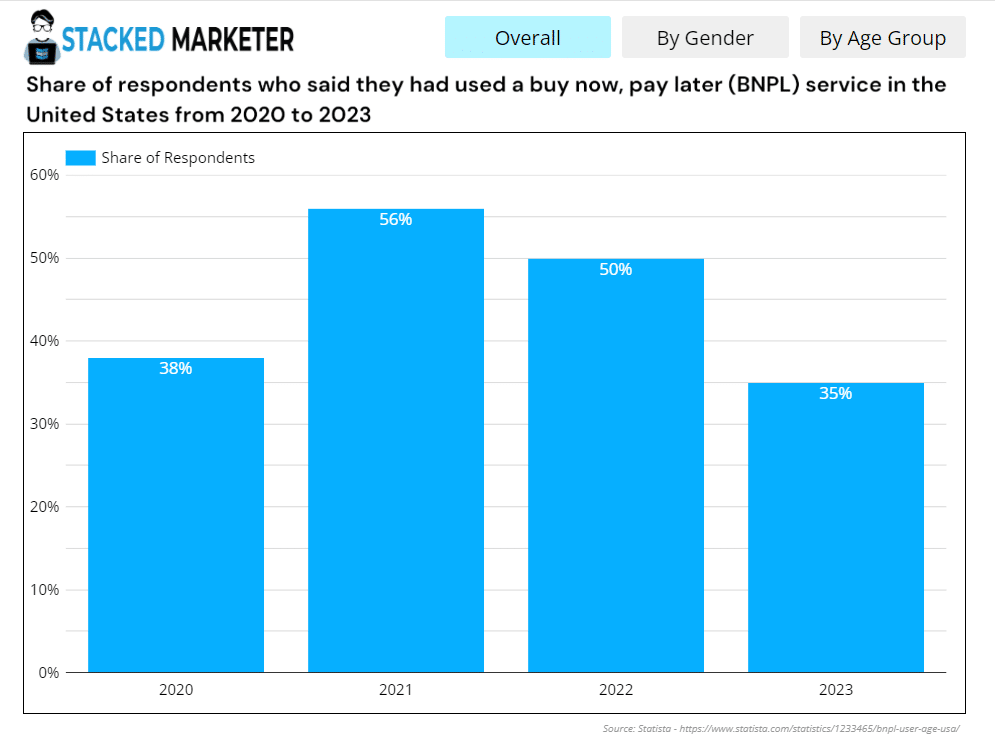

Shoppers were less likely to use a BNPL service in 2023 in the US

Right off the bat, it doesn’t look that good.

It appears that the peak of BNPL usage correlates with the peak of BNPL fintech companies.

Klarna—one of the biggest BNPL providers—reported a 70% rise in usage from 2020-2021 and at the time held the title of the “fourth most valuable startup in the world.”

Afterpay has also seen its biggest YoY revenue jump (67%) between 2020-2021. But the momentum didn’t last—with both companies suffering layoffs and revenue declines.

Which matches the chart below—where users were 15% more reluctant to commit to BNPL in 2023 than just a year ago. And 20% more than in 2021. Quite a decline.

💳📉 Why did the usage drop?

No clear data, but the economic climate in 2022 and continuing into 2023 made consumer behavior shift.

High-cost, non-essentials fell down the pecking order as people prioritize savings and everyday things, which don’t require BNPL. Plus, shoppers are less likely to commit to longer-term payment plans in unfavorable economic climates.

Ironically, a bad economic climate seems to push people away from split payments.

Will the BNPL industry fail?

It doesn’t seem like it will.

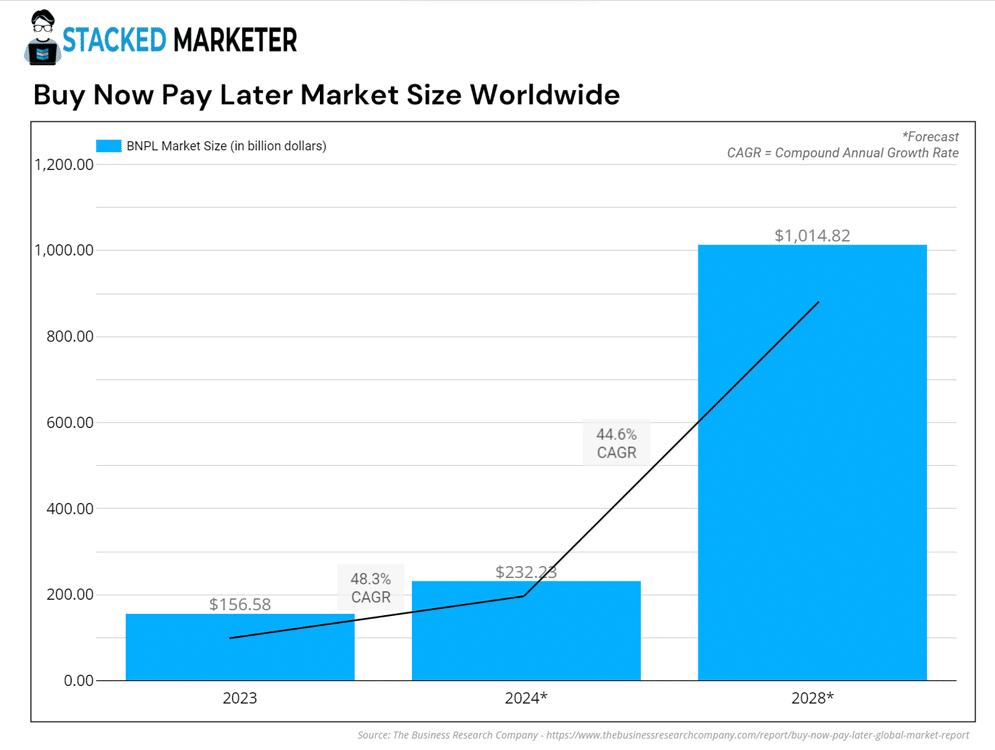

The global BNPL is expected to keep rising this year and up to 2028.

Now you’re probably wondering how that’s possible with users clearly declining in 2023?

There’s one possible answer.

Since we know that the financial crisis mostly affected medium-to-low-income consumers, those that earn more still spend—and on higher-ticket items that make BNPL convenient.

💡Lesson learned: If your store sells non-essential high-ticket products, adding BNPL could boost your conversion rate.

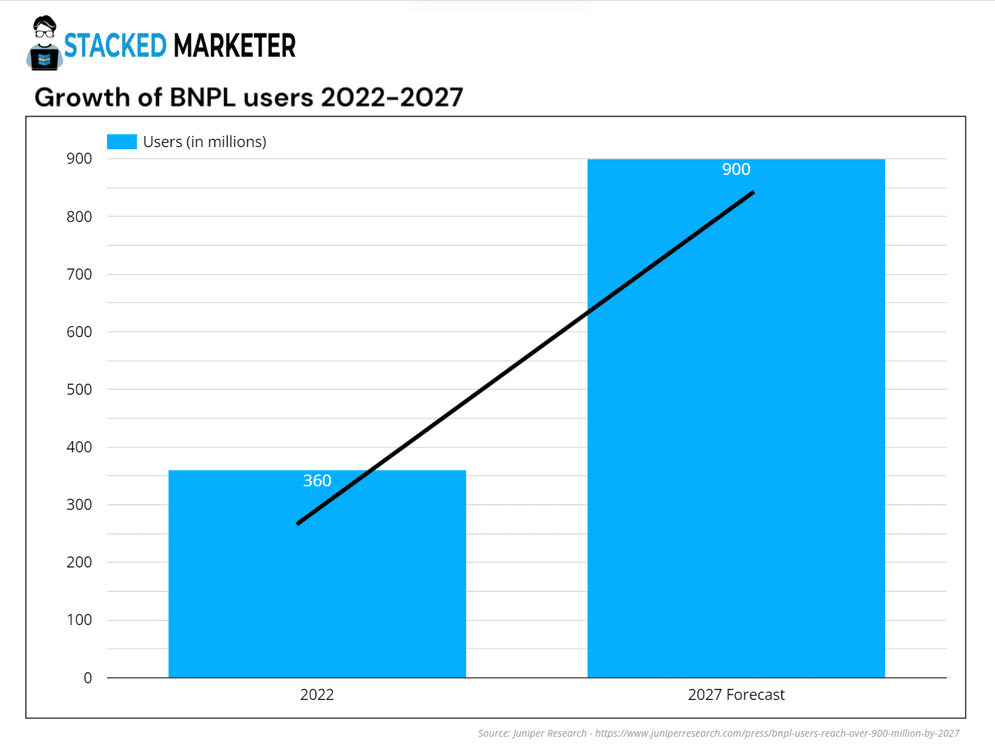

The users are also expected to grow:

But how—you may wonder—when there was decline in usage from 2022-2023?

A few reasons could factor in for this growth, according to the research:

- This survey includes the global market: And while US shoppers were cautious with BNPL in 2023, some big markets such as India are expected to see a 450% increased usage by 2027.

- Virtual cards will boost usage: The adoption of virtual cards by merchants in the coming years will allow BNPL companies to compete with credit cards. For example, single-use BNPL cards that can be used within digital wallets for transactions.

- Economy should get better: It’s borderline speculation, but there’s a possibility that with more spending power, more people will treat themselves with higher-ticket items, where split payment is convenient.

🌏CVR Boost: BNPL is big in the Asian market. Sennheiser—an audio equipment manufacturer—apparently saw 30% increase in sales, reduced cart abandonments, and 80% increase in GMV after leveraging BNPL in the Singapore market.

BNPL user growth and decline by demographic in the US

We know that lower-income shoppers are less likely to use BNPL.

But what about some other demographic parameters?

Here’s how the split looks between male and female:

Looking at this—even with the decline taken into account—male shoppers are more likely to use BNPL in the US.

And now when it comes to age differences:

It appears that youngsters split payments a lot during the pandemic and then dropped this habit, as were 55+ and older—who drastically dropped even in 2022, with now almost completely abandoning the BNPL habit.

The most “BNPL—friendly” shoppers appear to be users aged 25-54, who are also the most stable and at the peak of spending power.

If this age range falls into your demographic—you might consider adding a BNPL option.

🚨 BNPL doesn’t come without criticism, with two being most notable:

- It lulls people into a false sense of financial security and value due to the split payment structure, which can pull less finance-savvy people into more debt.

- There’s a lack of proper regulations when it comes to BNPL, which can, for example cause excess credit being handed to consumers who can’t pay it.

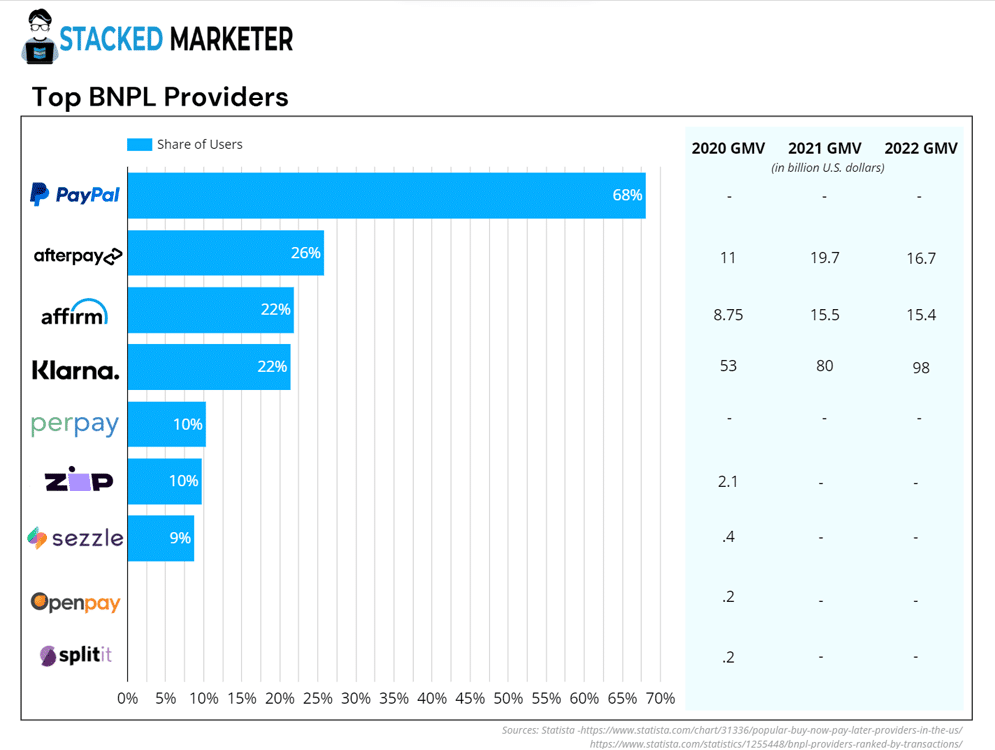

Big BNPL players breakdown

Finally, let’s see who’s making a name in the BNPL world.

Here is the breakdown by the user share and gross merchandise volume:

The left part of the chart shows the share of users who used the BNPL provider in the past 12 months (until November 2023), the right shows the GMV.

Some things to consider:

- PayPal’s pay in 4 option is the undisputed leader, but since Paypal isn’t a BNPL company, analysts don’t count it towards the $156B share.

- Klarna is the biggest and most used, but Afterpay is slowly establishing itself as a formidable competitor after being acquired by Jack Dorsey’s Block Inc.

- Affirm is boosted by its partnership with Amazon.

But how do all these companies sit in the grander scheme of e-commerce things?

Here’s a little overview:

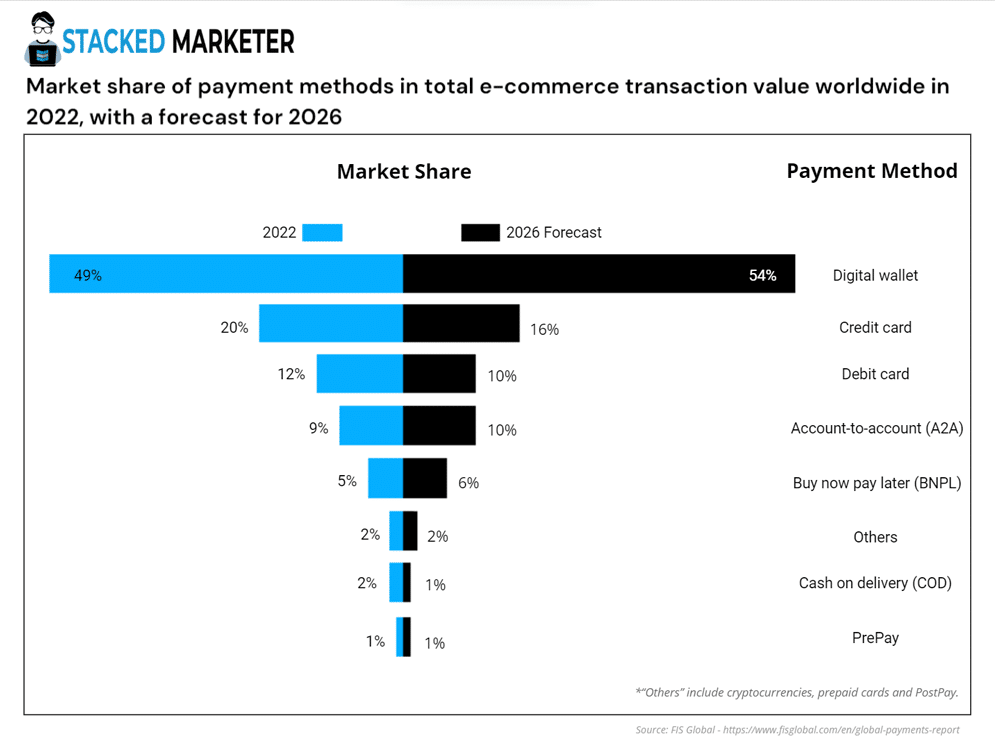

Not bad. With over 200 global BNPL providers that account for 5% of all global e-commerce revenue, you could say it’s a pretty vibrant industry with an exciting future.

Despite the recent hiccups.

Think now, pay later

The BNPL industry appears to be here to stay. Powerhouse companies like PayPal, Amazon are already leveraging it, while the market is expected to grow exponentially in the future.

If you’re a merchant who offers a high-ticket item and targets higher income customers, you might want to consider adding the BNPL option, if you haven’t already.

However, there’s a big possibility that if you’re selling lower-priced, everyday items you won’t see any significant impact by adding BNPL in the near future, with the BNPL fees not being worth it in the long run.

If you disagree, please let us know!

Sources

The report sourced data from the following: