We know that this Q4, aka “shopping season” is one like no other. The world is in the middle of the COVID-19 pandemic, physical stores will (probably) not run any promos in their brick and mortar locations, the U.S. elections are bringing political ad spend to new heights…

That’s why we asked our readers a few questions, in hopes that we can find the answer to what is going to happen in this unique Q4 for e-commerce businesses. Yes, only e-commerce!

Before we dig in, a word on the limitations of our survey.

233 answers are OK for an analysis but it’s far from a definitive answer across all e-commerce advertisers in the world. We will try to focus on answering questions where there is reasonable data but don’t take this as a definitive report.

If you aren’t already subscribed, you can check out our newsletter here. It’s free, you sign up just with your email and if you don’t like it, you can unsubscribe. No hard feelings.

How Will Q4 2020 Compare To A Usual Quarter?

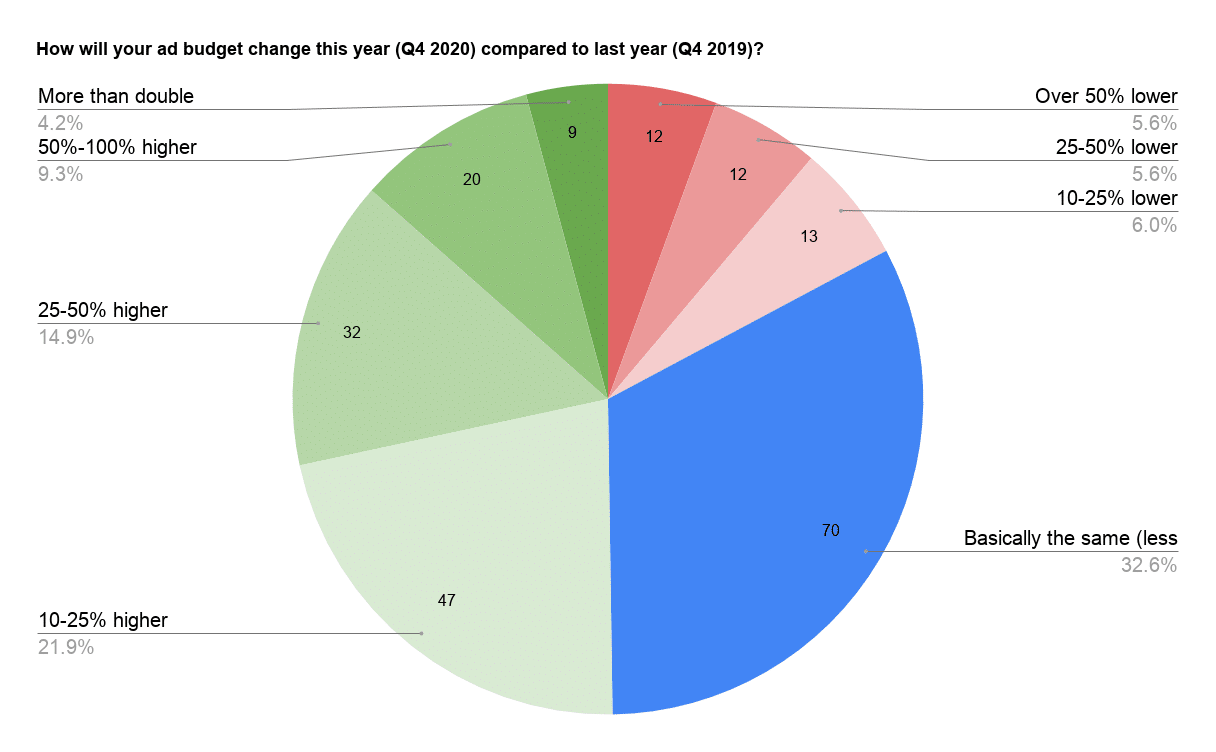

This was the first question we wanted to ask – especially in a year like 2020. Many advertisers actually increased their online ad spend in Q2, once the pandemic was declared, as customers transitioned to purchasing online. Still, we can say that Q4 is going to see an increase in ad spend, just like it would normally happen in a year.

As you can see, very few answers said they would lower their budget and the vast majority of advertisers are planning an increase.

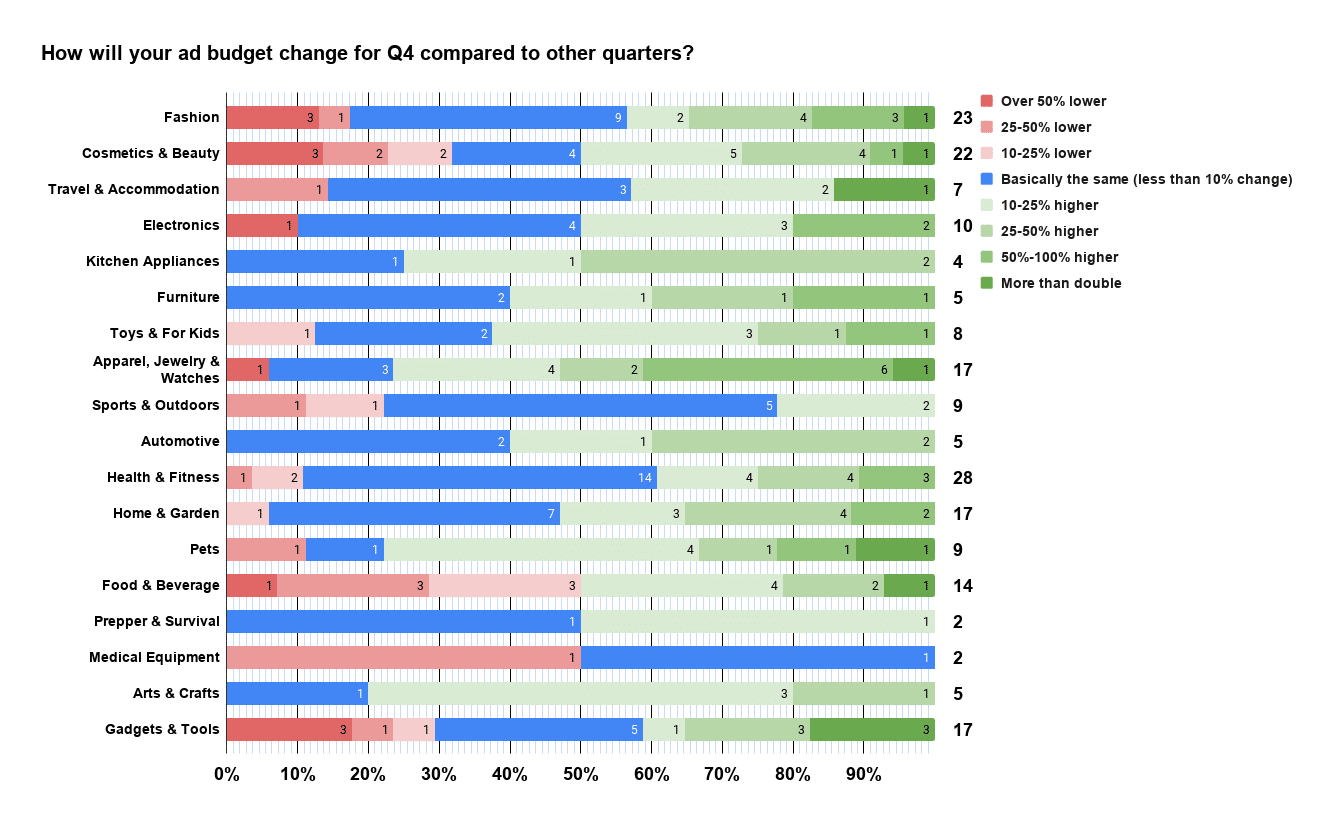

Luckily, we had enough answers to look into this question based on category as well.

The only category where the increase seems somewhat equal (or at least comparable) to decrease is the food & beverage category. Aside from that, it’s likely an increase across the board for any category that has more than a couple of answers.

This makes sense. Food & beverage is the one category where retail didn’t suffer in lockdown, with supermarkets being essential businesses that stayed open (and often saw an increase in sales).

But Will Q4 2020 Be Bigger Than Q4 2019?

Likely, yes.

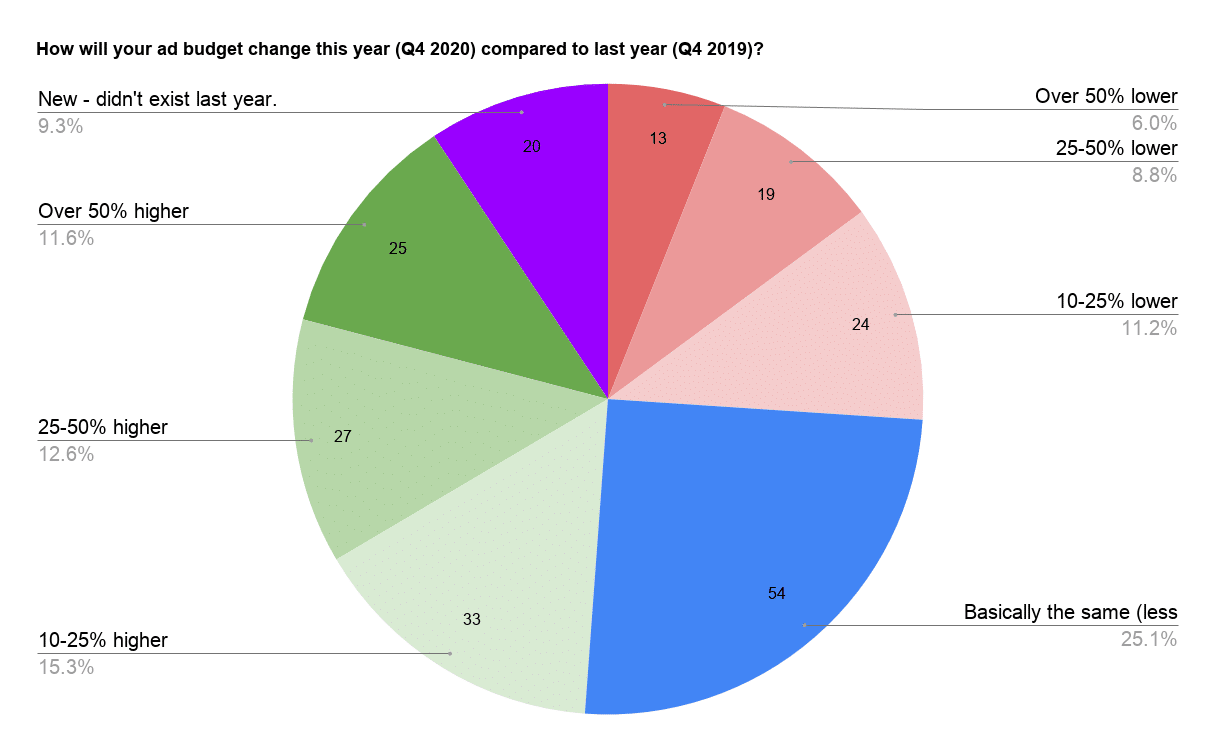

Doing the same analysis, this time comparing Q4 of 2019, this is what we have.

Two things to mention here. First, this only counts businesses who survived from last year until this one. There’s a survivorship bias (which is unavoidable, probably).

Second, while it’s not as overwhelmingly green (there’s also another category for new businesses), it’s still slightly pointing into the direction of “we’re going to spend more this year than the last”.

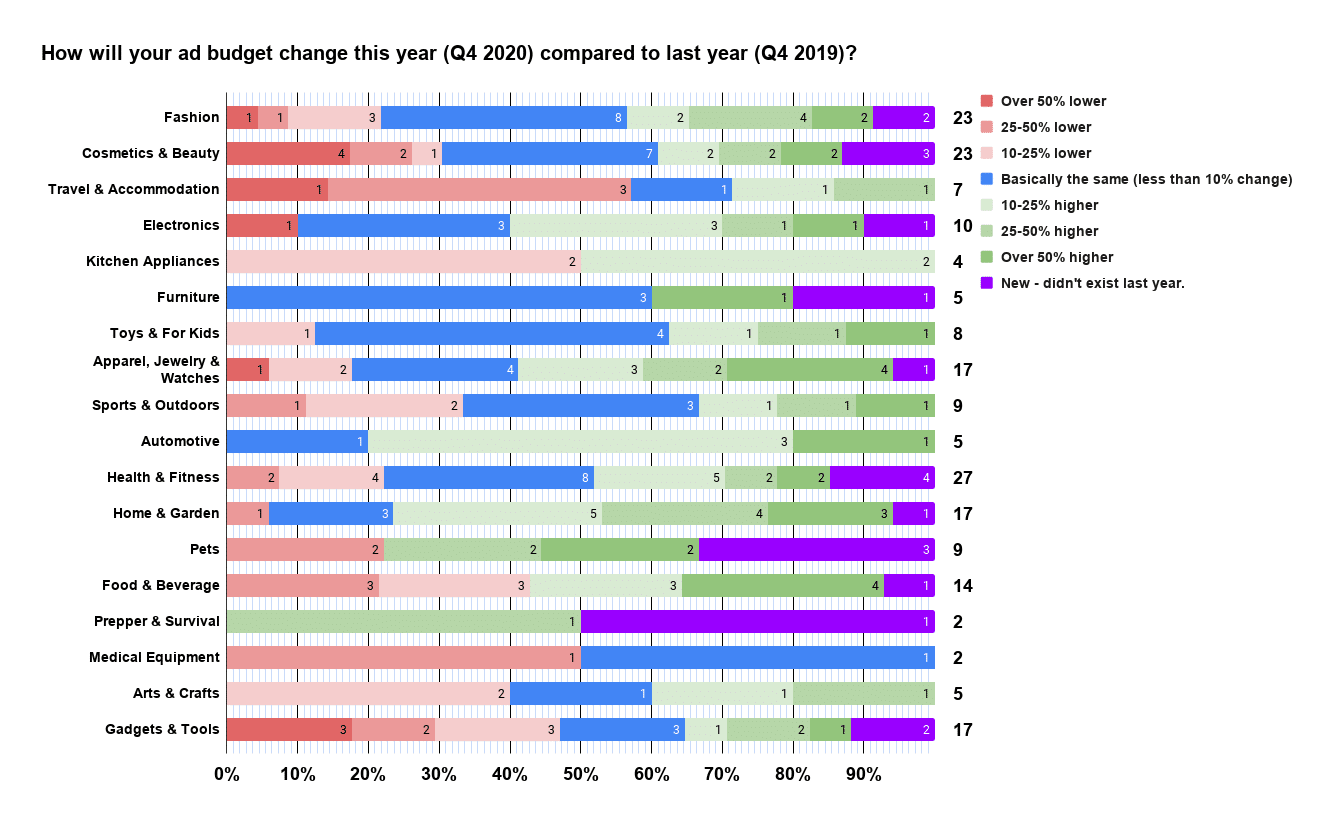

We also have the same breakdown by category, where we’ll see if there are any significant exceptions. 10 brownie points if you guess (without looking at the graph below) the one category that might not spend more this Q4…

To nobody’s surprise, travel & accommodation is suffering. People travel less, therefore need less travel gear.

Aside from that, all categories follow the trend when comparing quarters in the same year.

The answer seems quite clear. Online ad spend will increase in Q4 compared to usual quarters and this Q4 should have a bigger spend than Q4 of last year (2019). At least that’s the case for the typical Stacked Marketer reader…

One interesting comment from a reader who wanted to stay anonymous:

“In case of another lockdown, cosmetic and beauty will be the right products to choose IMHO (average roas 8 for ecom on these niches during last lockdown)”

Now that we know ad buyers will spend more, let’s look at where they plan to spend their budget.

Where Are Advertisers Spending Their Budget?

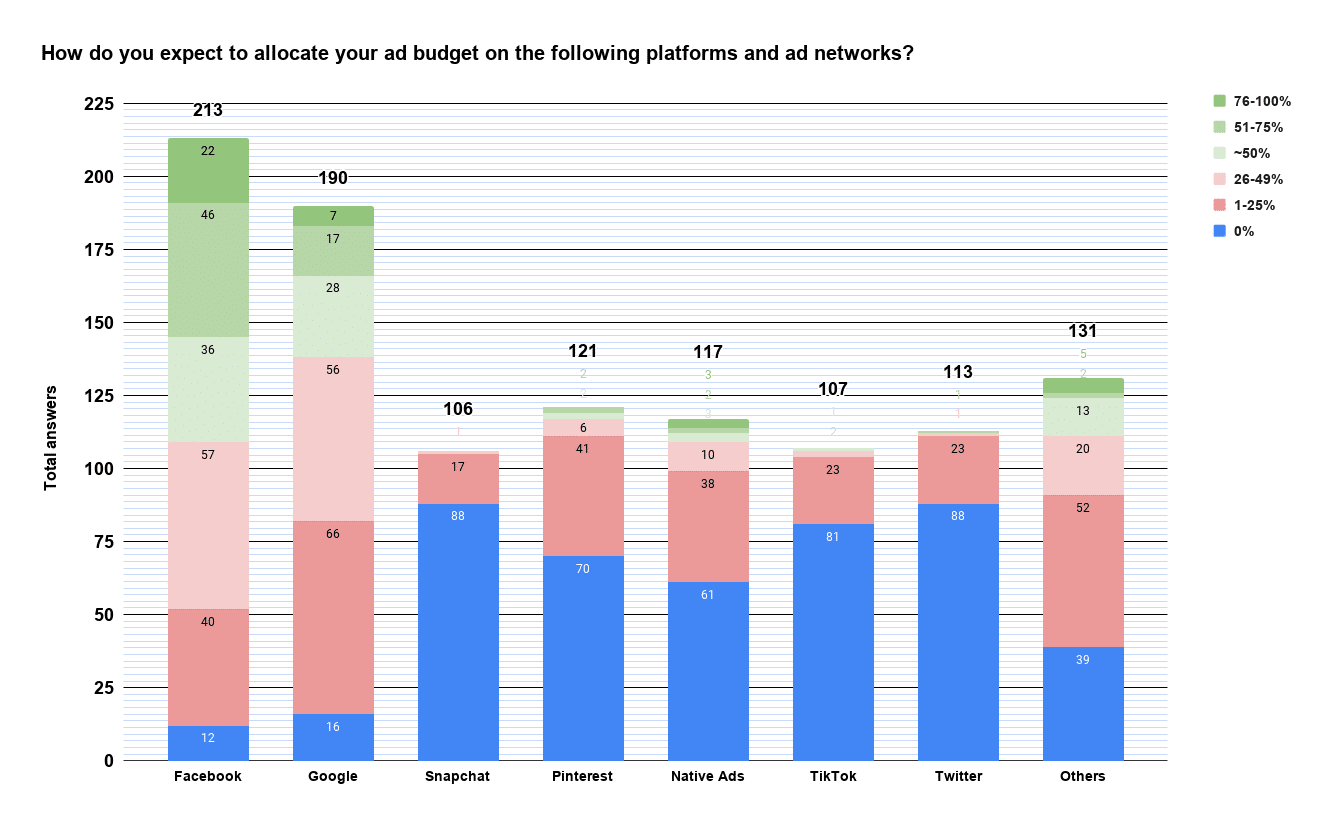

Surprised? We aren’t.

Facebook and Google are called a duopoly for a reason and they will take the biggest share of ad spend. If we asked this question during a normal quarter, the result would probably not be very different.

There’s also another factor this year, that applies to the U.S. only, but it is the dominant market for those who participated in the survey.

“COVID & the US Presidential Election both have “yuge” impacts on available inventory & competition in terms of CPC, CPV, etc. Negotiating with both of those will make Q4 bidding & optimization more important than in previous years.”

That’s why it is a bit surprising to us the low amount of budget allocated to Snapchat, Pinterest, Native Ads and TikTok given that they all have a good value proposition for e-commerce.

This might be an opportunity to explore. Here’s the train of thought we have. Advertisers are spending more than usual, but they plan to spend almost all that “extra” on Facebook and Google. Political ad spend will also be mostly on the same platforms. Therefore, the four trailing options (Snapchat, Pinterest, Native Ads, TikTok) will see a proportionately smaller increase in ad cost.

Some ideas from The Crew:

- Retargeting on native ads.

- Reach younger audiences on Snap and TikTok.

- Reach women on Pinterest, especially for certain categories.

Facebook and Google have a more mature ad product, we understand that. Their targeting is probably the best out there. But if your audience is the “everyone” on the platform, you don’t need to focus so much on targeting so research who uses those platforms and get your product in front of the right people.

OK, did we mention challenges?

Challenges Marketers Expect

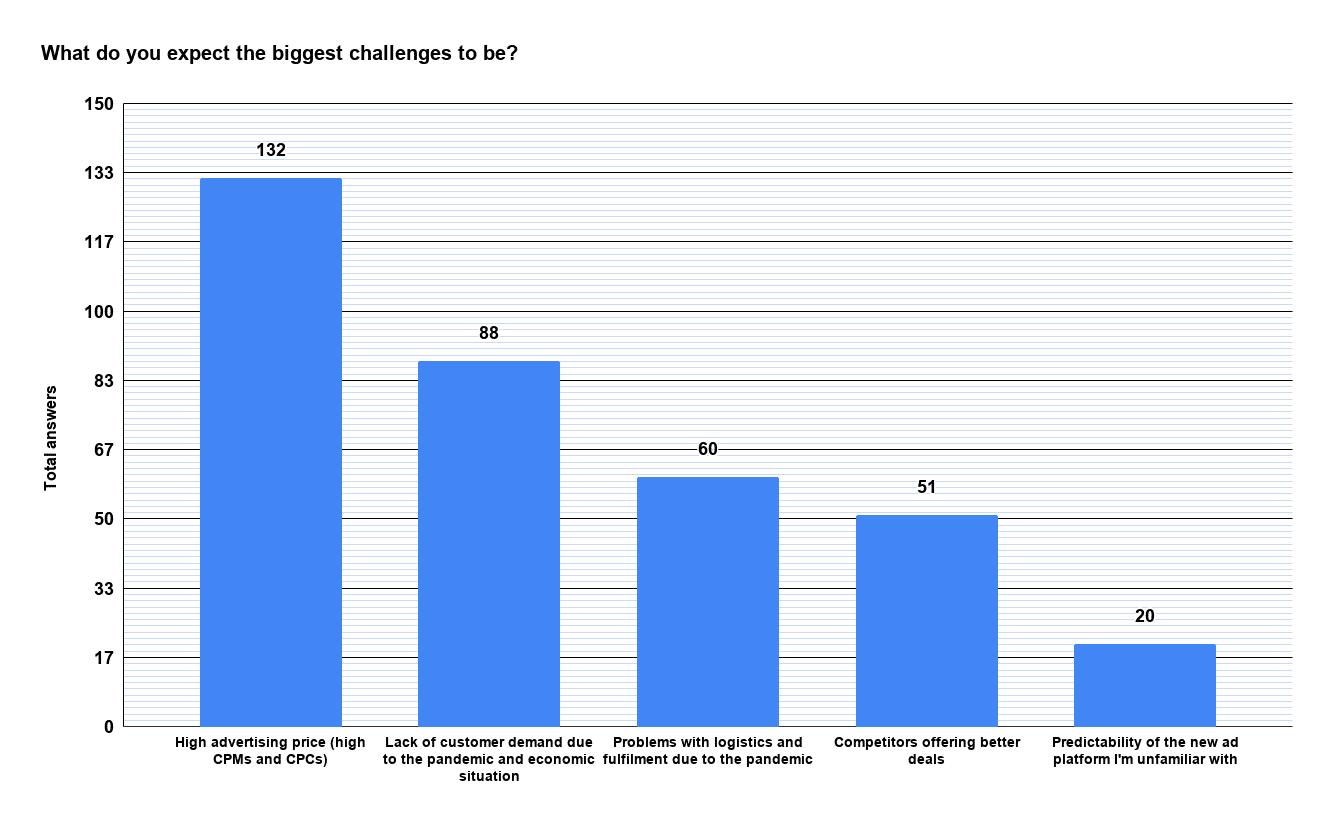

We’re going to end this on a bombshell. Advertisers already expect prices to increase. Shocker, right?

It’s perhaps the easiest prediction one could make but increased costs is the main challenge advertisers see in Q4.

Conclusions

While there are other challenges businesses face because of the pandemic, ad spend seems like it will follow the usual trajectory. That is to say, ad spend will increase in Q4.

As we mentioned from the very beginning, there’s a limitation to this report because of our sample size. Our readers also tend to lean more on the performance-focused side of marketing, so the answers will be more representative for brands focused on performance.

Use this info alongside other reports and information you find to figure what is best for your particular situation this shopping season.

We will end it with a comment we agree with, also anonymously submitted:

“I think the competition in the paid advertising space is going to be killing everyone no matter what vertical you are in, therefore, I will focus a lot on building an audience and building great report with those customers well ahead of launch and using that base to build on with paid ads”

In short, improve your SEO, build your audience, your email list and so on. Paying to reach the same people all the time is getting less appealing, year after year.